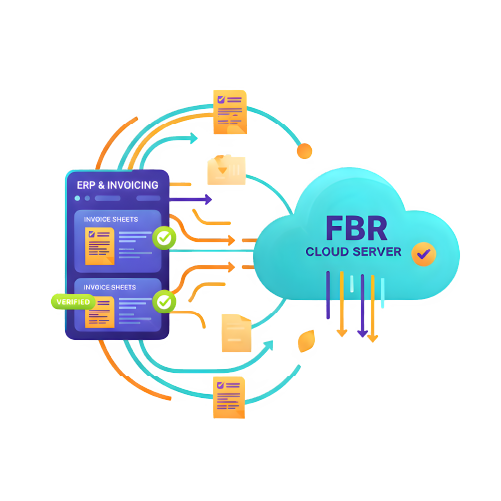

Direct FBR API Integration

Our system connects directly with the FBR API, ensuring every invoice is synced automatically without manual uploading. The moment you post a sale, it is transmitted to FBR in real time, keeping your business fully compliant and eliminating technical complexities completely.

ERPNext Compatibility

Specifically optimized for ERPNext users, our integration offers full customization for workflows, print formats, and automation. Invoices are submitted directly from ERPNext, ensuring a seamless, native experience without relying on external systems or manual steps.

Real-Time Validation

Every invoice receives instant validation from FBR, including IRN, QR code, and response status. You get real-time confirmation for each transaction, ensuring transparency, accuracy, and the peace of mind that every sale is properly recorded and authenticated.

Multi-Channel Support

Whether you’re running a retail POS, wholesale business, or online store, the system adapts effortlessly. It unifies all sales channels into one FBR-compliant invoicing pipeline, making compliance easy across branches, counters, and eCommerce platforms.

Tax Compliance

Every invoice is generated according to FBR’s digital invoicing standards, including tax details, QR codes, and IRN. The system ensures complete compliance, reducing the risk of errors, penalties, and mismatched tax reports for any type of business.

Secure Cloud Backup

Your entire invoicing history is safely stored in encrypted cloud servers, ensuring zero data loss and maximum reliability. Even if devices crash, your FBR-validated invoices and records remain accessible anytime, giving you a secure and uninterrupted compliance workflow.

Error-Free Tax Reporting

Track all invoice submissions through detailed logs that highlight accepted invoices, rejections, and retry attempts. Built-in error handling helps you identify issues instantly and resolve them quickly, ensuring uninterrupted invoicing and reliable FBR compliance at all times.